Fintech Development: Driving Innovation through Code and Strategy

In the modern age fast-paced digital economy, fintech software development plays a crucial role in shaping how we budget, build and secure financial resources. Technology has bridged the gap between traditional financial systems and evolving user demands whether it’s through custom fintech app development, embedded finance platforms, or AI-powered fintech innovations. From automating lending processes to building secure mobile banking apps, fintech developers and engineers are at the core of this transformation.

For companies aiming to lead in the era of Fintech 2025, prioritizing investment in scalable, secure, and innovative digital products is no longer optional it’s mission critical.

Fintech software development is the heartbeat of today’s modern financial world. It refers to the creation of software applications, platforms, and tools that deliver financial services more efficiently than traditional banking systems.

In 2024, nearly 65% of financial institutions are investing in software development for fintech, a number that is expected to grow by 20% annually through 2030.

Inside the Engine: Why Fintech APIs & Embedded Finance Are Game Changers

Fintech APIs enable financial services (like payments, KYC, investments) to be embedded into any platform whether it’s an e-commerce platform, a ride-hailing service or even engineering projects enhancing funding processes. This is the essence of embedded fintech, where users get access to financial services without leaving the app they’re using.

The industries thrive on fintech ideas to push the boundaries of conventional finance. Platforms that utilize Fintech-as-a-Service (FaaS) can launch faster, cut development costs, and deliver a smoother customer experience.

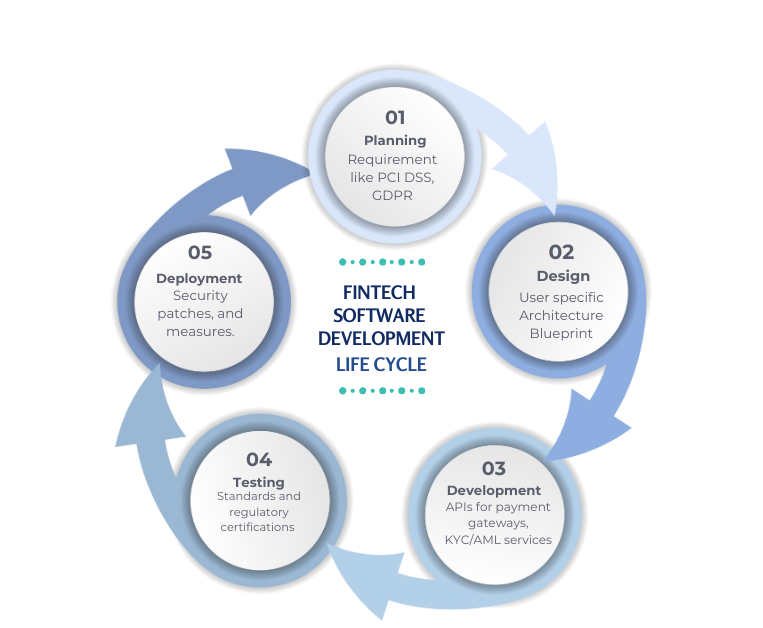

Fintech Development: From Idea to Innovation

Ideas Validation and Research:

- Identifying requirements and understanding business needs through fintech product managers

- Data analysis involving data scientists to identify patterns.

- Define key features and productivity fintech products will offer.

Planning on resources:

- Determine whether to choose for custom fintech app development or use fintech API platform.

- Compare costs, time to market and scalability

Design and Development Phase:

- Fintech Developers build in-house or utilize fintech development outsourcing focusing on user-centric fintech design for better UX.

- Boost personalization and risk analysis through AI integration and big data fintech.

Testing and Compliance:

· Navigate the challenges in fintech through rigorous testing

· Strengthen the software by meeting the fintech security protocols.

Scaling and Launch:

· Leverage content marketing fintech strategies for user acquisition

· Promote diversity to drive innovation in mass fintech hub.

Maintenance and Updation:

- Regular monitoring and issue resolution.

- Upgrade with latest fintech innovations and solutions.

- Using a fintech recruitment solution to analyse user feedback.

Embedded Fintech: The Next Big Revolution

Embedded fintech weaves financial services into non-financial environments, like e-commerce checkouts offering BNPL (Buy Now, Pay Later) services or ride-sharing apps providing insurance.

Fintech Development Outsourcing: Smart Scaling Strategy

Startups and growing enterprises are leveraging fintech development outsourcing to access top fintech engineers and fintech developers worldwide, reducing time-to-market and costs.A strong fintech software development initiative requires robust backend systems, intuitive user interfaces, and top-tier cybersecurity measures. Fintech software development demands compliance with financial regulations like PCI DSS, GDPR, and local banking standards.

Women in Fintech: Redefining Industry Leadership

There’s a growing movement of women in fintech and fintech women initiatives driving diversity and inclusion, essential for long-term innovation and market expansion. Inclusion of women not only in fintech but in every other technology related innovation is the groundbreaking move. Just for eradication of gender inequality in the workplace.

Established Techniques in Fintech Development

- API Integrations:

Fintech APIs streamline the integration of financial services, enabling seamless connections for payments, lending, and customer verification, enhancing the user experience.

- Cloud Computing:

Used to store and process vast amounts of data, providing scalability and cost-efficiency for fintech developers and organizations to innovate quickly.

- Biometric Authentication:

A key technique in fintech security, biometric methods like facial recognition and fingerprints provide secure and convenient authentication for financial transactions.

From startups to established businesses, fintech solutions enable enhancement in their services, improve user experiences and drive innovation. By integrating fintech security, leveraging big data, and incorporating AI and blockchain, companies can stay ahead of the competition.

FAQs

Q1: What Are the Key Challenges in Fintech Software Development for Emerging Markets?

A: Key challenges include limited digital infrastructure, regulatory hurdles, cybersecurity risks, and the need for scalable, mobile-first fintech solutions.

Q2: How Does Embedded Fintech Drive Innovation in Traditional Banking Models?

A: Embedded fintech allows non-banking platforms to offer financial services, helping banks reduce costs, innovate faster, and personalize customer experiences.

Q3: What Role Will Fintech AI Startups Play in Fintech 2025 Predictions?

A: Fintech AI startups will drive automation, fraud detection, big data analytics, and personalized services, reshaping how financial institutions operate by 2025.

Q4: How Do Fintech API Platforms Improve Security and Speed of Custom Fintech App Development?

A: Fintech API platforms offer secure data exchange, faster development, and flexible integrations, making custom fintech apps safer and quicker to build.

Q5. What Are the Major Fintech Cyber Security Concerns for Fintech Healthcare Applications?

A: Concerns include protecting sensitive medical and financial data from breaches, ensuring compliance, and defending against phishing, ransomware, and insider threats.

Q6: How Can Women in Fintech Help Shape the Future of Financial Technology Innovation?

A: Women bring diversity, leadership, and fresh perspectives, helping fintech companies drive more inclusive innovation and better financial products for all users.