Imagine you wake up in the morning, check your phone and see your portfolio has grown again. While the others were sleeping your AI model was working for you predicting markets and helping you invest in buying low and selling high finally concluding results for you. Sounds like a dream?

Let’s deep dive into how Convolutional Neural Networks Are Transforming Stock Market Predictions can be optimized by these models.

The Golden Question: Can AI Predict the Stock Market?

The stock market is fast, chaotic, and seemingly unpredictable. Millions try to “beat the market,” but only a few succeed. Traditional methods: manual chart analysis, gut feeling, or even basic algorithms fall short in a world driven by data, speed, and emotion.

That’s where AI, and especially CNNs, step in like financial superheroes.

What Exactly Is a CNN?

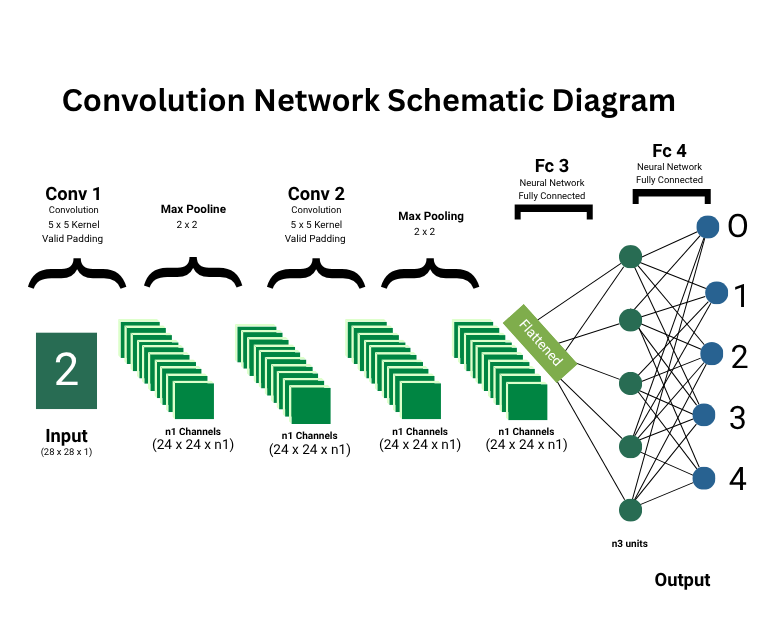

A Convolutional Neural Network (CNN) is a type of deep learning model that excels at detecting patterns. It was originally built for image recognition (think: facial detection or self-driving cars). But here’s the twist; you can convert stock market data into image-like formats, allowing CNNs to read market behavior like a chart expert on steroids.

How? Let’s break it down.

How the Stock Market Looks to a CNN

Your regular stock chart has candlestick patterns, trends, breakouts, and more. CNNs can analyze this data as if it’s visual detecting short-term fluctuations, sudden spikes, and patterns too subtle for the human eye.

CNNs process data like:

- OHLC (Open, High, Low, Close) values

- Trading volume

- Technical indicators like RSI, MACD, moving averages

- Even news sentiment transformed into numerical sequences

Instead of manually analyzing 100 charts, CNN analyzes thousands instantly.

Why CNNs Work Better Than Traditional Models

Forget lagging indicators. CNNs don’t just follow trends, they learn them.

Pattern recognition: CNNs catch technical patterns like head-and-shoulders, double tops, and trend reversals.

Noise resistance: Financial data is noisy. CNNs filter out the noise and focus on what matters.

Multivariate inputs: They combine multiple inputs—price, volume, news, economic data—into one intelligent decision-making system.

Real-time predictions: CNNs trained on historical data can make real-time buy/sell predictions when connected to live feeds.

Real-World Use Cases of CNNs in Finance

- Trend Prediction:

CNNs can forecast the next day’s closing price or direction (up/down) with reasonable accuracy when trained well. - Candlestick Pattern Classification:

Just like a technical analyst, CNNs can classify bullish or bearish patterns automatically. - Sentiment + Price Fusion:

Combine Twitter/news sentiment data with price charts to make smarter trades—CNNs can process both! - Portfolio Management:

Predict which stocks are likely to outperform and rebalance your portfolio based on predictions.

So… Can CNNs Actually Make You Rich?

Let’s be real: there’s no magic button for unlimited profits. But CNNs give you a powerful edge. In markets where milliseconds matter, and data floods in 24/7, having an AI that continuously learns and adapts is like having your own personal hedge fund algorithm.

With the right:

- Historical data

- Clean preprocessing

- Hyperparameter tuning

- And risk management strategy

…CNNs can significantly boost your chances of profitable trades and long-term returns.

But Wait, Know the Limits

CNNs are not fortune tellers.

- Markets are affected by black swan events, politics, war, and raw emotion.

- Overfitting to historical data can lead to false confidence.

- AI must be combined with sound strategy and risk controls to be truly effective.

Think of CNNs as your analyst team, not your financial god.

Ready to Build Convolutional Neural Network Stock Market?

Here’s how you can start:

- Collect historical stock data (Yahoo Finance, Alpha Vantage, etc.)

- Preprocess it into time windows and features

- Choose your CNN architecture (1D CNN, CNN-LSTM hybrid, etc.)

- Train, test, validate and don’t forget to backtest

- Connect it with a demo portfolio and track predictions

Final Thought: AI is Not the Future, It’s the Present

Those who combine finance and AI today are the ones who will lead tomorrow’s trading floors. Whether you’re a trader, data scientist, or investor, Convolutional Neural Network Stock Market can help you see patterns others miss and profit where others panic.

It’s not about guessing the market. It’s about understanding it better than anyone else.

FAQs:

Q1. What is a Convolutional Neural Network (CNN)?

A: A CNN is a type of deep learning algorithm primarily used in image recognition tasks. It can also be applied to time-series data (like stock market trends) by treating them as structured data patterns.

Q2. How is CNN used in stock market prediction?

A: CNNs process historical stock data (e.g., OHLC, technical indicators) as multi-dimensional arrays, identify patterns like trends and reversals, and use this to forecast future price movements.

Q3. What type of stock market data can CNNs analyze?

A: CNNs can analyze:

- OHLC data (Open, High, Low, Close)

- Trading volume

- Technical indicators (MACD, RSI, Bollinger Bands)

- News sentiment (converted to numerical features)

Q4. Why choose Convolutional Neural Network Stock Market over traditional ML model?

A: CNNs can capture complex spatial and temporal relationships in data, detect local patterns, and outperform traditional models in identifying subtle trends, especially when using visual or structured input formats.

Q5. Do CNNs directly predict stock prices?

A: Not usually. CNNs typically predict the direction of price movement (up/down), trading signals (buy/sell/hold), or classification of patterns rather than exact price values.

Q6. What tools or frameworks are used to build CNN stock prediction models?

A: Popular tools include:

- TensorFlow

- Keras

- PyTorch

- Scikit-learn (for preprocessing)